Get ready for the coming Bitcoin bull run.

Category: Finance

Bitcoin: The Bear Market Is Here

Are we in a bear market? I asked that question when Bitcoin (BTC) dipped below $30,000 back in July last year. If so, it would have been the shortest bull market in Bitcoin’s history. It used to be you could tell by the four-year cycle. But according to the four-year cycle, the bull market should have lasted at least into September and maybe November.

Then between August and November, Bitcoin (BTC) rallied to a new all-time high (ATH) of $69,000 on November 10. Maybe the four-year cycle was back. Many experts thought it would go above 100K by the end of December. Instead, it dropped. At times it would rally but still not get anywhere near the high in November. It would drop again, and rally again. The timing, one could argue, followed the four-year cycle.

I wrote a post earlier explaining why I think the four-year cycle may be dead. If it’s not dead, it certainly does not look like anything in the past. That being said, from November on is when we would expect a bear market. It could also be because traditional markets are down, inflation, supply-chain issues, the war in Ukraine, and all of that together seems to be pointing to a recession.

I came into crypto in a bull market. Now, whatever the cause(s), it looks like I’m going through my first bear market. Strategies have to change. What do you do with your crypto in a bear market? Everyone’s situation is different, so I can’t tell you what to do. I’ll let you know what I’m doing.

Keep in mind, though, I am not a financial advisor. Everything in this article is for information or entertainment purposes only. Always do your own research.

The Bull Is in Hibernation

I’m going to skip over discussion of how the economy in general is struggling. We all know the reasons. It’s not just affecting the United States but the entire world. That obviously makes people less willing to invest in anything, so we should not be surprised at the recent downturns in traditional markets, Bitcoin, and Altcoins. Every market is affected. But there are some factors unique to Bitcoin that are affecting it on top of the general state of the economy. That is what I will focus on.

Opinions from experts vary on when the bear market started. If you believe the four-year cycle, it started on November 11. For me (in my amateur opinion), the moment I switched from “maybe” to “definitely” bear market was the recent crash of LUNA and UST. It totally wrecked some people.

But before I get into that, when people experience an extreme financial loss, their minds can go to a dark place. I don’t want to use the S-word, because some algorithms don’t like it, but it has happened with every stock market crash. If you are thinking of harming yourself, please talk to someone. The National Suicide Prevention Lifeline is available 24/7 at 1-800-273-8255. No matter how bad it looks, money can be replaced. Your life cannot. Don’t confuse your net worth with your self-worth.

I don’t mean to make anyone feel worse than they already do. But there are important lessons we can learn from this experience. I’ll talk about my experience with the Luna crash, and then get into lessons for moving forward. I think the most important lesson is you are not your money. You are not your investments. You are not your portfolio. You are a child of God, a unique human being. Don’t ever forget that.

The Fall of LUNA and UST

Terra Luna (LUNA), a recent top ten cryptocurrency, crashed. Its stablecoin, US Terra (UST), crashed with it. And when I say crashed, I mean they both went to nearly zero. Tens of billions of dollars in market capitalization just vanished in a few days. Quite a few people lost money from both LUNA and UST, because they worked in tandem. The fate of one was directly tied to the other. Some of my YouTubers are saying it was market manipulation. I can’t confirm that, but I wouldn’t be surprised. Now that big money is buying crypto, manipulation is always possible. There’s another reason never to invest more than you can afford to lose.

Some people invested way too much in it, and it wrecked their portfolios. Some even lost their life savings. In a way it is understandable. Stablecoins are supposed to be the safe play, and it was possible just a month ago to get 20% interest on UST. So naturally people thought this was a safe investment with a guaranteed return of 20%. Who wouldn’t take that?

But if your portfolio got wrecked, or you lost your life savings, that means you put much more into LUNA and/or UST than you should have. But don’t despair. Whatever you lost can be replaced. You can come back stronger if you take the lessons of this experience to heart.

My Experience with LUNA

I dipped my toes into LUNA and UST. I bought LUNA at about $52. Within two weeks it was up to $92. When it reached $104, I should have sold half of it to make back my investment. Then what happened to the other half wouldn’t have hurt. Of course, if I knew what was coming I would have sold all of it.

But I not only held, I bought more, because when you see it going up like that and everyone in the crypto community is high on the project, you think it will keep going up. There was a certain minimum I wanted to have for my portfolio, and I had it. Yay!

On May 9 LUNA started crashing, from a price of $64 to now less than a penny.

It was a top 10 crypto in market capitalization. Now, I don’t know where it is in the rankings, and I don’t care. UST was put out by the same organization, Terra Luna Labs. I tried that, too.

My Experience with UST

I wanted to take advantage of the 20% return on UST, but I had to do some research to find out where and how to do it. UST is a stablecoin backed by LUNA. In case you don’t know, stablecoins are cryptocurrencies that are designed to keep their value at $1.00. They may fluctuate a fraction of a penny, or even a penny or two. But if it’s working properly, the price will always come back to $1.00. It should have been a safe play.

When I first saw LUNA and UST dropping, I did not realize how bad it was. I saw UST at $0.89, obviously much lower than it should have been.

This has been known to happen occasionally with other stablecoins, but with them it was temporary. I bought a little, figuring when it got back to a dollar, I could make some profit. But a little more research showed me just how much trouble they were in, so I sold at $0.70. Even though it was a loss of 20%, it was the right move, because UST is now trading at less than a dime.

I wasn’t able to sell my LUNA. Every time I tried, the order would not go through. That can happen in a crash, because in order to sell you need a buyer. Who wants to buy something that is dying a quick death? Keep that in mind when you do your risk evaluation.

Many crypto experts are doing autopsies on it. To listen to them now, it should have been obvious this crash was coming. However, only a handful of experts predicted this would happen. Let this be an object lesson that investment always carries some risk, so NEVER INVEST MORE THAN YOU CAN AFFORD TO LOSE.

And the problem is bigger than LUNA and UST. In the same time LUNA dropped to zero, the whole crypto market lost over $300 billion, with Bitcoin dropping 15% from before the crash.

A Little Hope

Do Kwon, the founder, is trying to fix LUNA and UST and bring it back, and he seems to want to find some way to help investors who got wrecked. That means there is still a chance people can recoup their losses and even make a profit if they are patient. But I don’t have the same confidence in him that I did before the crash. Whatever he comes up with, I will probably stay away from. But if he offers a way to reimburse some of my losses, I’ll take that. There is talk of a “new LUNA” that will include an airdrop to those held the “old LUNA” before the crash, so maybe we can still recover something.

Regulation Coming

There is one more issue I need to address. LUNA and UST may not recover, but the crypto market almost certainly will. It has survived much worse than this. What concerns me more is bad regulation that could come in the wake of this. Treasury Secretary Janet Yellen is calling for sweeping federal regulation of stablecoins. SEC Chairman Gary Ginsler wants to call almost every crypto a security, so he can regulate it. He has already said stablecoins are securities, which makes no sense. And of course he is in the spotlight with the SEC’s lawsuit against Ripple Labs, the creators of the XRP cryptocurrency. The uncertainty around what’s coming makes me nervous.

I am not an anarchist. I don’t mind regulation. Like most people in the crypto community, I just want clarity, fairness, and common sense. Given the track records of Yellen, Congress, and especially Ginsler, I don’t have much confidence that is what we’ll get.

An Ounce of Prevention

Before investing in anything, here are a few rules to remember.

First, recognize that is a risky game to begin with. Before you invest in anything, ask yourself, am I okay if this goes to zero? With each Altcoin, the chance of going to zero varies. I think Bitcoin has been around long enough that the chance of it going to zero is virtually nil. But even with Bitcoin I ask myself that before I buy. If the answer is no, that means I’m investing more than I can afford to lose. Either spend less or move on to something else.

Second, you can protect yourself by taking profit, meaning when you have a chance to sell at a decent profit, take it. Between September 2020 and April 2021, I was able to let my Altcoins double in value, then sell half. That way I recovered my investment, and whatever I could gain after that was gravy. That is pretty easy in a bull market. But in a bear market, you may need to think in terms of 10, 20, or 30% profit.

Third, use stop-losses. If you don’t know what that means, it means you need to educate yourself before you even think about investing.

Fourth, NEVER INVEST MORE THAN YOU CAN AFFORD TO LOSE.

Fifth, don’t put all your eggs in one basket. Professionals tell you to diversify your portfolio, and that goes for crypto, too. Putting all your money into one or two Altcoins is like putting it all into lottery tickets.

Help! My Crypto Is Down!

Even if you take those steps, at some point your crypto will go down in value. You have three choices:

- Sell at a loss.

- Hold until the market goes up again.

- Trade for a better crypto.

Let’s talk about each of them.

Sell at a Loss

Sometimes that is your best option. For Bitcoin, I think holding is usually the right move, unless you need to pay some bills (not financial advice). But with Altcoins, you need to be ready to sell. I learned the hard way “hodling” is for Bitcoin, not Altcoins (with maybe a few exceptions). From now on, I’m taking profits when I can. And if that Altcoin turns out to be a Sh*tcoin, go ahead and take the loss.

It was no fun selling my UST at a 20% loss, but it was absolutely the right move, especially considering it’s trading at less than a dime now. I would gladly have sold my LUNA at any price, but now it’s totally worthless.

Professional investors have this already built into their strategy. When they take a chance on a risky investment, they put in a stop-loss. That means you can set it up where if the price drops, say, 20%, it will sell automatically. That will keep you from getting wrecked.

Selling at a loss is no fun, but sometimes it is better to cut your losses than stay in a sinking ship.

Hold until the Market Goes up Again

There are nearly 20,000 Altcoins listed on coinmarketcap.com. Many if not most will not survive the bear market. The few that do, however, will gain more than BTC, simply because they are smaller and have more room to grow. Knowing that makes people sometimes hang on to losing Altcoins longer than they should. Myself included.

I am holding (or “hodling”) my Bitcoin no matter what happens. Except if the price goes above 100K, I might sell a small percentage, because you always need cash. I believe Bitcoin has the fundamentals to survive the bear market and take off again in the next bull market. That is also true of a few Altcoins. There are a few I’m holding on to, even though my investments currently are in the red. If I need the cash, I might sell to pay bills and wait to re-invest when I’m better situated financially. This bear market is likely to last for a while, so if it’s a good project, you will get another chance.

It’s okay to sell your Altcoins, whether to take profit or cut your losses. But if your research tells you the project is solid and a good long-term investment, it’s okay to hold too.

Trade for a Better Crypto (or Other Investment)

Everything in the crypto market went south between May and July of last year. It caught me by surprise. According to the four-year cycle, we should have still been in a bull market. I had small investments in probably twenty different Altcoins. Bitcoin dipped hard in May because of FUD from Elon Musk, and my Altcoins dipped shortly after. I was looking at selling everything at a loss.

With most of them, instead of selling I traded them for Bitcoin. All those investments had lost value relative to the dollar. But Bitcoin rose and fell in tandem with them, so their value relative to Bitcoin was still roughly the same. It didn’t feel like a loss because of that, and because when Bitcoin pumped again, I recovered those losses. Well, I would have if I had sold. More on that in another post.

That looks like the situation we’re in now as well. There is always some risk. But in a bear market, I’ll take my chances with Bitcoin over any Altcoin. It has been around for thirteen years, longer than any other crypto. It has seen multiple bull markets, bear markets, and black swan events, and it is still here. Even when it dumps, it dumps less than Altcoins. It is the most secure network anyone has ever built. No one who has ever bought and held for at least four years has lost money. How many investments can say that? In fact, I am almost to the point where I’ll take my chances with Bitcoin over any other investment period.

So if your Altcoins have lost their shine, I always think trading for Bitcoin is a good move (Again, not financial advice).

Moving from Risk-on to Risk-off

Also in a bear market, you need to be more conservative with your investments in general. Professional traders and investors use the terms risk-on and risk-off. Risk-on refers to assets that are new, speculative, and could bring either great gains or big losses. In other words, risky. Risk-off refers to assets that have been time-tested, are less volatile, and likely to bring smaller gains but also smaller losses if the market goes down. Ask your financial advisor what that means in practical terms.

In a bull market, you can make great profits with risk-on investments. But in a bear market, the professionals will move their money out of risk-on investments and into either risk-off or cash. More traditional investors are selling their Bitcoin than they have in recent months, because they consider it a risk-on investment. Personally, I would call BTC a risk-off investment (for reasons stated above), but I’m not a professional. Talk to a financial advisor about it first and do your own research.

But traditional investors moving away from BTC is another indication we have entered a bear market, so you may want to consider stocking up on more traditional investments for now. We are likely in for a rough few months. Crypto Jebb saw a bear flag formation on the charts that could mean BTC is going down to $20,000. You don’t have to know what that means.

Just know that it’s possible. In the past, BTC has dropped as much as 85% from previous highs during bear markets. We saw a high of $69,000 November. A drop of 85% would take it to $10,350. All of that to say even though the price has stabilized for now, we may not have seen the bottom yet. Add to that the challenges of inflation, the supply chain issues, whales possibly manipulating the markets, the war in Ukraine, regulatory uncertainty, and a natural bear market on top of that means, well, I don’t know what it means, but it won’t be good most likely. If nothing else, I think we can still count on another bull market after the next BTC halving, which is estimated to take place in May, 2024.

But just as bull markets present opportunities that don’t exist in bear markets, bear markets present opportunities that don’t exist in bull markets.

The Silver Lining

The silver lining of any bear market is that if you can identify good long-term investments, now is a time to buy the dip. Back in October and the beginning of November, people were saying, “I wish Bitcoin would dip, so I could buy some.” What do you think this is? Bitcoin is settled at about $30,000 for now. That is over 50% off from the previous high of $69,000. If that’s not a dip, what is? But remember, only buy if you are not going to need the money any time soon. It could be a while before the bull market returns.

But what if it goes down further?

Buy it again. (Not financial advice). As Warren Buffett says, “Be fearful when others are greedy. Be greedy when others are fearful.” In other words, sell when most people are buying. Buy when most people are selling. Of course, that only applies to long-term investments. If you think BTC is a good long-term investment, now is a great time to accumulate.

My preferred strategy for buying is dollar cost averaging (DCA). This is like if your employer offers a 401K. The best way to invest is to have it deducted from your paycheck automatically. That way, you don’t miss it. DCA works the same way. You set up with an exchange to buy automatically on a regular schedule. Some weeks it is lower, some weeks it is higher, but on average I am getting a good price.

I started with $10/week of Bitcoin. Even on a tight budget, you can probably work that out. I don’t know your situation, but there is probably something you can sacrifice to get started purchasing something for your future. Coinbase and Gemini are two exchanges that let you set up recurring buys (same as DCA). Their transaction fees are pretty high, though.

There is a service called Deltabadger that will allow you to avoid most transaction fees on your DCA. You can go on their website to see which exchanges you can work with. I use Coinbase Pro, but there are several others. If you sign up with this link, you will save 10% off your first purchase. And you don’t have to pay at all until you buy $1200 worth.

Sign up for Delta Badger here.

If you want a more detailed account of what happened with LUNA and UST, you can watch this.

Thanks for reading. I hope this was helpful. How are you feeling right now? Are you hodling or selling? Which projects do you think will survive the bear market? Which ones won’t? Let me know what you think in the comments.

It Only Works if You Believe in It. And That Is the Problem.

The Prosperity Gospel makes big promises of health, wealth, great relationships, and success in all your endeavors. The promises often don’t come true. When they don’t come true, the most common answer to why is you didn’t have enough faith. But the good news is you can exercise your faith and make it stronger. How do you build your faith? Romans 10:17 says, “So then faith cometh by hearing, and hearing by the word of God” (KJV). What you hear over and over again, you will eventually believe. They combine this with a belief that what you believe and speak will come to pass (Mar 11:23-24). So don’t give up. Keep listening to positive, faith building messages. Stay away from negative, “It will never happen” messages. Keep believing you received your blessings, keep speaking as if they have already come, and they will come. So if I keep listening to and believing the promises of prosperity in the Bible, I will become prosperous. I will get that book deal. I will write that bestseller. In the meantime, I will have a day job that pays the bills, leaves enough leftover the give to my church and the poor, and includes full benefits. All of that can be mine if I believe and do not doubt.

After several years of believing and (not) receiving, I realized the problem with this is it only works if you believe in it. No matter how many messages I listened to that God promised to both meet all my needs according to God’s riches in glory, and give me all the desires of my heart, when month after month, year after year, it came time to pay the bills, and I had nothing leftover, how was I supposed to keep believing? I tried. I kept meditating on the scriptures that promised health, wealth, and success. I kept listening to them on tapes, CDs, and TV. I kept confessing prosperity, not poverty. But it was like this guy I heard of who showed up to work one day with his hand in a cast.

“I was in my karate class and about to break bricks for the first time. I meditated to get my ki going. I knew I could break those bricks. I raised my hand up. I knew I could break those bricks. I brought my hand down with all my might. I knew I could break those bricks. My hand was about to make contact. I wasn’t sure I could break those bricks.”

That is what “believing and receiving” all those promises of health, wealth, and success year after year did to me. Much as I wanted to, I could not force myself to believe I had money that I didn’t have. The only way this could ever work for me was if I could found some promise in the Bible that did not depend on my belief, and my doubt could not stop. It could not be like a placebo, where it only works if you believe in it. It had to be like gravity, where it works whether you believe in it or not.

Just Obey. No Belief Required.

Well, I found it. There is a scripture on tithing that appears to promise prosperity whether you believe in it or not.

Bring ye all the tithes into the storehouse, that there may be meat in mine house, and prove me now herewith, saith the Lord of hosts, if I will not open you the windows of heaven, and pour you out a blessing, that there shall not be room enough to receive it. And I will rebuke the devourer for your sakes, and he shall not destroy the fruits of your ground; neither shall your vine cast her fruit before the time in the field, saith the Lord of hosts.

(Mal 3:10-11 KJV)

God is saying, prove me. See if I will not open the windows of heaven for you. See if I will not pour you out a blessing that there will not be room enough to receive it. See if I will not rebuke the devourer for your sake. None of that “first believe, then you’ll see” nonsense. God told the nation of Israel here, just obey, and you will see. So if I give at least 10% of my income, no matter how small, to a “Bible preaching, Bible believing church,” I should see more money roll in for me than I have room to receive.

So here is a promise in the Bible that does not require you to believe, only obey.

Tweet

Now in case you’re thinking this verse did not promise money, it promised “a blessing,” there are many ways God can bless you, money is only one way, and the blessing might come in a different form, that is not the way the Prosperity Gospel reads it. The Prosperity Gospel says this promises wealth to those who tithe. For the Israelites, wealth was in land and crops. God promised to make their land produce crops in abundance if they tithe their harvests. Wealth for us today is in money. Therefore, God will bless you with an abundance of money if you tithe 10% to a “Bible preaching, Bible believing church or ministry.” By that, they mean it has to be a church or ministry that preaches the Prosperity Gospel.

It makes perfect sense. It serves God’s interests as well as yours. You give God 10% of your income, and God will grow your income so that the 90% you keep is greater than the 100% you would have made without God’s blessing. 10% of more means your tithes will get bigger as your income gets bigger. As your tithes get bigger, God will bless you with more money. 10% of more means your tithes will get even bigger. And that cycle will just keep repeating until you don’t have to be concerned about money anymore.

How will the money come? It’s not going to just fall out of the sky or magically appear in your bank account. It might come through raises or promotions at work, that big contract that seemed out of reach before, the book you write that becomes a bestseller, or people might just give money to you. Why? Because God told them to. Prosperity preachers say that last one happens to them all the time. I wonder why people do that? Maybe because they tell people by giving to them, you are giving to God, so God will give to them in return. After all, their books become bestsellers by telling you how to get rich by giving to them. Isn’t that wonderful? God is so good.

My Tithe Check Bounced

There’s the punchline of the joke of the Prosperity Gospel. My tithe check bounced. I don’t mean when I was just starting out, and there had not been time for money to reach me. I had been diligently setting aside 10% of any income I made, no matter how small. Even if it was $10, I would set aside $1 for the tithe. Thirty years I had been tithing faithfully, and finally there was not enough money to cover it.

And it wasn’t a faith check. You know what a faith check is? That’s when you write a check and believe God for the money to cover it before it gets cashed, because you don’t have the money in your account at the moment. Very bad idea, and even Prosperity preachers will discourage it. I never did that, or at least I thought I didn’t. When I wrote that check, I honestly thought I had the money in my account to cover it. But this was one of those instances where I had missed my payment the month before, so I put two month’s tithe on that one check. You know how much it was? $200. After thirty years of tithing, I did not have enough money to cover a $200 check. How much was I making? 10% = $100. Do the math, and you’ll see I was not even close to “a blessing for which you do not have room to receive.” And again, the Prosperity Gospel is clear. The blessing in this verse is supposed to be money. It’s been thirty years. Where is my money?

It didn’t work for you because you don’t have enough faith.

Oh no! You don’t get off the hook with that excuse this time. This verse says it will work whether you believe in it or not. “Prove me now herewith, saith the Lord of hosts, if I will not open you the windows of heaven, and pour you out a blessing, that there shall not be room enough to receive it.” God said, “Prove me now,” not “It only works if you believe in it.” The only thing required was obedience, not belief. I gave God thirty years to prove himself. What happened?

Context, Context, Context

If you read my last post, you know what happened. The Prosperity Gospel takes that verse completely out of context. I listened to people who told me that God promised me things that God never promised me—or you. In that post, I give a detailed explanation of why this Malachi scripture has nothing to do with making us rich. I won’t rehash the whole thing here, but here are the main points.

- The promise was made to the nation of Israel, not to the church, not to any other nation, and not to you and me as individual believers.

- The tithes in Israel were taxes, not the voluntary offerings we give to the church.

- The tithes were food, not income. The purpose was to ensure there was food for everyone, even the poor and those who had no land.

- God was telling people who were already rich to pay their tithes, i.e., taxes, not telling people who were poor how to get rich.

- God did not tell the rich they will be richer if they tithe. The metaphors of opening the windows of heaven, and a blessing that they will not have room to receive only meant that they would have more than enough for themselves and their families. It was not an investment with guaranteed positive ROI (Return on Investment).

So if you are tithing because you think God will give you back more than you give, just remember God never promised that. That was the trap I fell into, believing God promised me things that God never promised me. And how did I fall into that trap? By listening to people who profited by reading the Bible out of context. Think about it. If your preacher says, “Look how rich I am. It’s because God blessed me. God blessed me because I tithe. And God will bless you if you tithe,” who receives those tithes you pay? Who receives those tithes everyone pays?

They might say, “It doesn’t go to me. It goes to the church.” But who controls the purse-strings of that church? Do they tell you how they spend all that money they receive? My church shows the budget to all the members, and we vote to approve it. So we know how much our pastor makes. If he showed up to church driving a Mercedes or a Lambo, you’d better believe we would ask him where he got the money for it.

Where Do We Go from Here?

It may sound funny to say this, but I am grateful for that bounced check (with apologies for whatever inconvenience it caused my church). Because any time my prayers for healing, income, a job, protection, or building a career as a writer were not answered, prosperity preachers could it was my fault for doubting too much or not having enough faith. But when it came to this scripture, they could not say that. The deal here is, if I obey this one commandment, God will bless me financially. There is no other requirement. I obeyed. How can it possibly be my fault? What should I conclude from that?

One thing I love about Jesus is when his enemies would try to trap him by presenting him with two options, both of which were bad, he would catch them in their own trap. For example, should we pay taxes to Caesar or not? If he says yes, he will be discredited to those who believe he is the Messiah. If he says no, he will be in trouble with Rome. Which is it, A or B? In situations like this, he would choose C. He held up a coin and said, “Whose image is on this?”

“Caesar’s.”

“Give therefore to the emperor the things that are the emperor’s, and to God the things that are God’s” (Mat 22:21 NRS).

They gave him two choices, thinking “Heads we win, tails he loses,” and he chose a third option they had never even considered.

So back to the question of why God wasn’t filling his end of the bargain when I tithed, it seems we only have two choices here. A., the Bible is wrong. Or B., God wants to bless me financially, but somehow I keep screwing it up. It can’t be A, so it must be B, right? That’s why I fell into the trap of always trying to get more faith. But I never seemed to have “enough faith” to make it happen. But this promise specifically says it does not depend on my faith. God was practically daring Israel to tithe and see if they receive more wealth as a result. Could it be that there is a C that I had never considered?

C. They are reading the Bible out of context.

You think what they say has to be true because it comes from the Bible. I will say this a thousand times if the Lord lets me live long enough. Just because they are quoting scripture does not mean they are speaking the Word of God. The Bible is only the Word of God when it is rightly read, rightly interpreted, and rightly applied. And rightly doing all of that begins with three things: Context, context, and context.

By now, I think I have shown that in context, this is not a promise of positive ROI if you give 10% of your income to your church. It is not a way for the poor to get rich, and the rich to get richer. It was a message to the rich that if they paid the tithes God commanded, they would still have plenty for themselves and their families. Not more than before, but more than enough. If you still don’t see that, again I will refer you to my previous article where I explain in depth the tithe Malachi was referring to. The tithes were meant to help the poor, not bring more hardship to them.

And in the New Testament, there is no minimum amount we are required to give to the church. Not 10%, not even 0.1%. We give not under compulsion, not under the threat of a curse if we don’t, or expecting a return as if we are investing in stocks or cryptocurrency. If you have a heart to give to your church, then by all means give. The church needs money to operate, just like any other organization. Give as you are able, and give with a willing heart, because God loves a cheerful giver. And remember, money is not the only thing you have to offer. You can give of your time by volunteering, serving on a committee, visiting sick church members, teaching Sunday school, singing in the choir, or ask your pastor where they need help. And never let them bully you into giving more than you can afford.

The lesson I learned was much bigger than the purpose of tithing or even the right way to give to the church. It taught me something about the true nature of faith. Faith is not something to manipulate God into giving you what you want. It is a relationship with God based on trust. You can ask God for what you want, and whether God gives it to you or not, you trust that God always loves you and will work whatever happens for good. When understood like that, faith is not something you use as a means to an end. It is an end in itself.

Thank you for reading. Feel free to leave a question or comment below. No trolling, but I am happy to engage in honest discussion and debate. As always, remember these words from Matthew 7:12.

In everything do to others as you would have them do to you; for this is the law and the prophets.

(NRSV)

Grace and peace to you.

How to Survive a Bitcoin Bear Market

Confession time: While we were in quarantine, a lot of people picked up new hobbies. My new hobby is Bitcoin and cryptocurrency. I was a skeptic for a long time, but now I’m a believer. The problem is I spent so much time learning and planning trades it consumed my writing time. I’m going to have to learn balance. But the best way I can justify that time I spent is to write about it.

A quick disclaimer: I am not a financial advisor. Anything I say is for educational and/or entertainment purposes only. Any financial product or service, including particular crypto currencies, exchanges, stocks, experts, or whatever I use as examples do not constitute an endorsement. Always do your own research.

I have owned some Bitcoin for only a little more than a year, so I can’t say if we are in a bear market now. But the fact that we are having that debate at this time took me by surprise. If you don’t know, Bitcoin is a cryptocurrency, meaning it is “a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend.” So it is an asset that exists completely on a vast computer network. Bitcoin was the first and is by far the biggest cryptocurrency in terms of market capitalization. Coinmarketcap.com lists over 10,800 crypto currencies that can be bought, sold, and traded on exchanges, similar to stocks and commodities. Some of the more popular exchanges are Coinbase, Binance, Kucoin, Gemini, and Kraken.

Also like stocks and commodities, the value can go up or down depending on supply and demand. If more is being bought than sold, the value goes up, and vice-versa. While Bitcoin is the focus of this article, I may refer to other cryptocurrencies (a.k.a., cryptos) for comparison.

If you have heard anything about Bitcoin, it’s probably that the price is very volatile. It can go up very quickly and back down just as quickly. I already knew that, but I thought I had the market figured out. The Bitcoin (BTC) price normally moves on a four-year cycle because of an event called the halving. At set intervals, the amount of Bitcoin that can be mined (the term for creating new Bitcoin) drops in half. This diminishing supply coupled with greater demand makes the price go up for about 16 to 18 months before there is a bear market. The most recent halving was in May, 2020. Based on that, we should have had a bull market until at least mid-September, maybe even into October or November. Until May 12, it was playing out that way. Then Elon tweeted, and the price crashed.

We are now 50% down from an all-time high in April. This was supposed to be a bull market. How could one tweet break the cycle? Or maybe the cycle is not over, and this was just a much needed correction. But a 50% correction in a bull market? And we haven’t recovered yet? Should I hold on and hope the price goes up, or get out now to cut my losses?

Many who bought in March or April are asking the same thing. Again, I’m no expert, but I’ll tell you how and why I got in, and what I have learned in this crash.

How I Got Started with Bitcoin

When I first heard about Bitcoin in 2013, and it sounded like a pipe dream. I didn’t see how a currency, asset, or whatever you call it, could exist only on computers and have real value. Last year, I saw a presentation that explained what currency is and how it works. We are used to currencies having a physical form, for example, gold, bills, coins, etc. However, that is not really necessary. Anything people accept as a medium of exchange can be a currency, even if it is entirely digital. So yes, Bitcoin can be real money. El Salvador has even made it legal tender for the whole nation.

I also learned about the blockchain technology behind it. A blockchain network is the most secure network ever created. The first Bitcoin was mined, or created, on January 3, 2009. Since then, the Bitcoin network has never been hacked, because the blockchain it uses is so secure. Forget about cryptocurrency for a minute. Just think about an Internet that is virtually unhackable. Do you think there could be some other applications for that? Bitcoin and the whole crypto market is not even the tip of the iceberg of blockchain’s potential. That more than anything convinced me Bitcoin and cryptocurrency are here to stay.

My First Bitcoin

I bought my first Bitcoin in June last year, shortly after the halving. The price went up, slowly at first. Then on October 21, 2020, Paypal announced users could buy, sell, and spend Bitcoin and other cryptocurrencies directly from their accounts. The price went up pretty steadily from then on. There were a few dips, but they were not deep, and they did not last long.

By the time Coinbase, one of the biggest cryptocurrency exchanges, IPO’d on April 14, the price was up to an all-time high of about $63–65K (prices vary some between exchanges). In the next few days, there was a pull back, and the price hovered in the 50’s for a few weeks. That wasn’t so bad. Even a bull market will have corrections like that.

Then on May 12, Elon Musk tweeted concerns over its energy use and climate change. I care about climate change, but in this case I think the concern is overblown. I plan to write another article to explain that, but this chart will give you an idea.

As you can see, the latter two use more than twice as much energy. Furthermore, the energy Bitcoin uses is more likely to come from clean, renewable sources. I wonder what would have happened to the banks if Elon had raised concerns about their carbon footprint. If people knew about how damaging gold mining is to the environment, would they stop buying it?

But Elon’s 56 million Twitter followers got the message. The price dropped about 15% in just one day and kept falling. At the bottom, it reached lows of about $29K, a more than 50% drop from its recent all-time high. Most experienced crypto investors know this kind of volatility is normal. But even many of them were surprised that such a drop happened when we are supposed to be in a bull market. Experiences like that create FOMO (Fear Of Missing Out) and FUD (Fear, Uncertainty, and Doubt). You could also think of them as fear and greed, and they tend to move the markets more than one mercurial billionaire.

FOMO and FUD: How You Can Be Your Own Worst Enemy

What is the mantra of professional investors? Buy low, sell high. FOMO and FUD will make you do the opposite. Here’s how they work together.

You heard about Bitcoin a few years ago, and you thought it was silly. You haven’t thought about it in years. Then you hear it broke its previous all time high of $20K, and it’s going up, up, up. $30K, $40K, $50K, $60K. You don’t understand how it works, even at a “Bitcoin for Dummies” level. You don’t know any market fundamentals. You don’t know what makes the price go up or down. But you are afraid of missing out, so you rush to buy before it’s too late (FOMO). Then the price falls: down, down, down. Just when you think it can’t go lower, it does. You are afraid of losing everything you put in, sell at a loss, and promise never to do that again (FUD).

Experienced investors use this FOMO and FUD to enrich themselves. When everyone FOMO’s in, they sell. When everyone FUD’s out, they buy. The best protection against FOMO and FUD is to educate yourself. Learn the history of why Bitcoin was created. It’s a fascinating story. Learn how cryptocurrency compares with fiat currency (dollars, euros, etc.). Learn what blockchain is and how it works. You don’t have to get too technical, just enough to where it makes sense. Learn about the halving and the four year cycle. And most of all, listen to people who have held Bitcoin for four years or more. They have seen markets go way up, way down, and everywhere in between, and they are still in the game. That will give you the perspective you need.

I guess what I’m trying to say is don’t invest in something just because the price is going up or some celebrity tweeted about it. Get at least a basic understanding of what it is, what value it brings to the market, why the world needs it, whether the business model is sound, how much investment it is attracting and from whom, and risks versus potential reward.

With Bitcoin, the four-year cycle has meant it reaches an all-time high about 16-18 months after the halving. Despite this downturn, there is still time for that to happen. Then it drops 85% before beginning to recover. If that happens again, will you beat yourself up or see it as a buying opportunity?

It Is Not a Get Rich Quick Scheme

Of course, I knew that before I got started. But it is easy to forget when you see the price go parabolic. When the price skyrocketed to an all-time high of about $65,000, I started having visions of all the remodeling my wife and I want to do and retirement by the end of the summer. Then the price went into free fall, like Tom Cruise in Mission Impossible, when his assistants stopped him just before he hit the floor, but he’s just hanging there with his arms and legs up to keep from setting off the alarm.

At first, I was scared. But as the price has settled in the 30,000’s, I realized this crash was the reality check I needed. There are some newer cryptocurrencies that saw over 1000% gains this year alone. Bitcoin is not that kind of investment. It is so big now, it takes much more to move the price up than for something like Polygon (MATIC), which currently sells at about $1.05.

Of course, with greater rewards come greater risks. Many of those with 1000% gains dropped back to pre-bull levels in the crash. Even though they’re not connected, most cryptocurrencies follow Bitcoin in the market. If Bitcoin pumps, they will pump more. If Bitcoin dumps, they will dump more, so the losses can be much greater as well. Some even went down to zero, so make sure you do your research before jumping in. Bitcoin has been around long enough that it’s highly unlikely that it will go to zero now. But if you expect to get rich with it, you have to think in terms of years, not weeks.

So what do you do when the price drops?

Buy the Dip

If you don’t believe in it as a long-term investment, the emotional roller coaster will drive you nuts. If you do believe in it as a long-term investment, you won’t get caught up in the hype when it goes up, and a price dip is a buying opportunity. Large investors have been buying even during this crash, which is the one reason I don’t believe this bull market is over. Who knows how long this opportunity will last?

How should you buy? You could try to time the market. When I think about how I bought at $9.7K, it’s tempting to think I could have sold at $63K. That would have been over a 600% gain. And then I could have bought back in at $29K to prepare for the next bull run. But I had no way of knowing where the top or the bottom was. Professional traders have very sophisticated market analysis tools, and even they get it wrong sometimes. That is why I believe the best strategy for buying is dollar cost averaging.

Dollar Cost Averaging

This is a way you can take advantage of an extended price dip without having to guess which way the market will go. On most exchanges, you can set up a recurring purchase, where you buy a set amount every day, week, or month. That is called dollar cost averaging. It’s a way to minimize your risk, because you’re not putting all your money in at once.

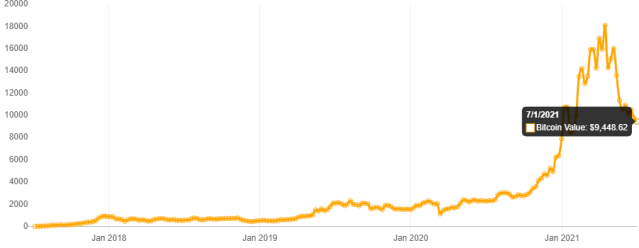

When I started out, I set up to buy $10 of Bitcoin per week on Coinbase. The price went up slowly from June to October, and I kept buying. When the price went up much more noticeably, I stopped my weekly buy and made bigger, less frequent purchases. But even when the price is going up, dollar cost averaging is not a bad strategy, because the price will come down at some point. On average, it still works out in the long run. The following chart shows what dollar cost averaging with $10/wk would have yielded today.

$10/wk for four years equals $2090 invested. For July, 2021, that results in a value of $9448. That is a gain of about 352%.

But no matter how I buy, I do not put in more than I can afford. I have heard of people losing their homes because they bought too much and at the wrong time. This market is much too volatile for you to spend the money for your rent, mortgage, groceries, water, electricity, children’s education, or any other essentials. I approach this like a retirement account. I do not put in money I need for daily or monthly expenses. I do not put in money I am likely to need in the next few years. I put in a little at a time, because I expect it to appreciate in the long run. If you are comfortable with that approach, the next strategy is for you.

Bonus Tip: Prices tend to be lowest on Friday mornings, so that is when I like to set weekly buys.

Hodl

That is not a typo. Thanks autocorrect for making me retype it. On December 18, 2013, someone with the username GameKyuubi posted on the Bitcoin Forum with the title “I AM HODLING.” Why? Because in his own words, “I’m a bad trader and I KNOW I’M A BAD TRADER.” The gist of it is good traders know when to buy and sell, but he doesn’t. Trying to time the market is a trap for most traders. You end up buying high and selling low, the opposite of a good trading strategy. But he has figured out that the overall trend is up. What do you do with an asset that is volatile but goes up in value over time? You buy and hold (or hodl). The crypto community still likes to use that term today.

One obvious advantage is you never say, “I should have sold or traded then.” Whenever you have that thought, you just remind yourself, “No, I am hodling.” I want to be clear, though, this not a good strategy for every cryptocurrency. I used to think I had to hodl at least some of everything. Now, I hodl Bitcoin (BTC) and Ethereum (ETH). There are a few others that I don’t exactly hodl but am reluctant to sell. Any others I have no problem selling if the price goes up, or if it is time to cut my losses. There is no way I can keep up with every crypto that is supposed to be “the next Bitcoin,” so I am very selective about it.

Another advantage is holding onto any asset, including crypto, for at least a year will reduce your tax liability. So next I want to talk about taxable events for crypto currency.

Be Aware of Taxable Events

I am not an expert, so check with your accountant or tax advisor on this. If you don’t have one, you will probably need one once you get into crypto. I learned that buying crypto is not a taxable event. If all you do is buy and hold, you won’t have to worry about taxes on Bitcoin or other crypto. Good for you, hodlers. Selling or trading one crypto for another is taxable. For example, if you want to sell some of your Bitcoin to take profit, or exchange some of it for Ethereum (ETH), those are considered taxable events.

As I understand it, if you trade one asset for another, any profit on that trade becomes taxable. That might mean if you buy that Tesla with Bitcoin (assuming they bring that option back), you might have to pay extra taxes, because you swapped one asset for another. Unlike El Salvador, Bitcoin is not considered currency in the US, so using it to buy something could make you liable for capital gains or other taxes. Again, I am no expert, so don’t take my word for it. That’s just what I have heard.

But unless you are 100% hodling, you will likely have to pay taxes. There is some software available to help you navigate that, so I’ll tell you what that is like.

Daily Interest Payments on Crypto Might Not Be a Good Thing

There are many good opportunities to earn interest on crypto, and I encourage you to investigate them and find one or more that works for you. However, with what I know now about crypto tax software, I would avoid offers of daily interest payments on any cryptos for now. Let me explain. The programs I’ve seen are free up to a certain number of transactions. Once you cross that threshold, you will have to pay. How much depends on how many transactions you’ve made. That includes all transactions — buy, sell, swap, move, or gifts. Any transaction whatsoever.

When I joined Coinbase, I took advantage of their Earn program. They offer the chance to earn free crypto by learning about it. That was a good thing. I got between $3-$6 in several free cryptos just for learning, which I was happy to do. A few of them offered 4–6% APY in interest, which was much better than the 0.1% I was getting from my bank. I was like, Great. Not only do I get free crypto, I get interest on it. And on Coinbase it’s compounded daily, so it will gain faster. And if the crypto takes off, I will have just a little more boost to it. Each of those daily interest payments was another transaction. Do you see where this is going?

I had a couple hundred or so transactions that amounted to nothing but counted toward my transaction limit on the tax software. I know my dollar cost averaging creates more transactions, and I’m okay with that. I didn’t know each and every one of those miniscule interest payments would count towards the number of my transactions.

I had to shop around, and the cheapest software I found was koinly.io. Even with that, I was going to have to pay $99. Fortunately, I was able to get a summary report for free. This year, I probably will have to pay for a full report. But I will try to do it without all those negligible interest payments, maybe putting all of it into one total transaction if possible. The only way I would take daily interest payments now is if I had a large enough balance to where the payments actually amount to something. I mean, if you’re getting 6% interest on one million dollars, that would give you daily payments of $164.38. I could live decently on that. Otherwise, to save on your tax software, you might want to look for weekly or monthly payments.

Despite tax liabilities, you might want to take some profit if the market goes up again. I’ll talk about that next.

Taking Profits

You could adopt a “modified hodl” strategy, where you take profit when the price is going up. My ideal strategy is when the price doubles, sell half. Then you will make back your investment, and you can hodl the rest. I was fortunate to be able to do that not only with Bitcoin but some of the other cryptos I had invested in last year. Of course, that only works if you buy at a time when the price can still double or more. That is why you want to buy the dip. Whether it’s a temporary correction or a bear market, buying when the price is down sets you up to take profit during a bull market.

What should you do after selling? Paying off some high interest debt is always a good thing. If you have that taken care of, experienced investors set aside part or all of their profits and wait to buy the next dip. Then when the price goes up again, they take some profit so they can buy the next dip. Rinse and repeat. That is how crypto fortunes are made.

“Corrections”

When I bought my first Bitcoin, the price was about $9700. As I write this, the price is now just under $35K. That’s a gain of over 200%, even with the recent crash. I understand, though, if you bought in at 40K, 50K, or 60K, you’re not feeling great about your decision now.

Though I don’t have any gift of prophecy or crystal ball, I feel confident in saying the bull market will return. The question is when and for how long. Will we have to wait four years to see any gains, or will the market come back in the next few weeks? Again, history says a bear market will come, if it’s not here already. I just don’t believe this is it.

But one more thing that surprised me. One of the reasons cryptocurrency was created was to eliminate the need for a “middle man” in financial transactions. Third parties like banks, credit cards, Western Union, and Paypal take fees for facilitating transactions. Cryptocurrency, theoretically, should reduce those fees significantly, but in practice that is not always the case. Ethereum’s ERC-20 network especially has seen fees go up a lot in the last several months. Bitcoin (BTC) has nothing to do with ERC-20, but sometimes its fees are too high as well. One thing you can do is convert BTC to Litecoin (LTC), which has much lower fees, and then trade, sell, or withdraw it.

What Comes Down Must Go Up?

For now, I want to leave you with this. If you bought for the first time at the top of this market, that doesn’t mean you made a bad decision. There is a saying in the Bitcoin community: “When in doubt, zoom out.” That means when the chart looks bad for a month or two, look back a year or two, or even going back from the beginning to now.

You might be wondering if it’s too late to get in. If you believe in Bitcoin long-term, then this price dip is a great time to buy. If you don’t believe in it long-term, then it is probably not for you.

Past performance is no guarantee of future performance. It is an extremely volatile asset. Parabolic gains and crashes come with the territory. But there is enough history to be optimistic in the long run. It’s hard to see this on the chart, but in 2013, the price dropped 80%, then rose 2300%. Will we see a similar bounce in the coming weeks? I don’t know, but anyone who has bought and held for at least four years has come out ahead. In July, 2017, the price averaged around $2600. If you bought four years ago and held, while people are complaining about a price hovering between $33–37K, you would be up over 1200%. Where do you want to be four years from now?

Just understand there is still some risk to it. I think in the next two or three months, the price could go to six figures. But if this really is the end of the latest bull market, the price could drop to $20K or even lower, and we will either have to hodl or wait for the next bull market to take profits.

Conclusion

So if you are just getting started, or considering getting started, here are the important lessons I’ve learned in my first year:

- “When in doubt, zoom out.”

- Dollar cost averaging is the easiest, lowest risk, and most stress-free way to get into this (or any) market.

- Consider hodling or modified hodling.

- It’s okay to take profit in a bull market. Have a strategy for when and how to do that.

- If you are looking to get rich quick, look elsewhere.

- For tax calculations, daily interest payments might not be worth it. Weekly or monthly payments might work better for you, depending on how many transactions you want to do.

- Watch out for high transaction fees. Converting BTC to LTC can help with that on some exchanges.

- You don’t need expensive programs to learn how to do this. There is plenty of good information available for free.

- Seek advice from people who have been in for at least four years. That way, they have seen at least one complete bull and bear market.

- Don’t rely on one source to tell you what to do. You should have three or more different sources. Look for people who have a lot of experience and a track record of putting out good information.

- Certainly do not listen to people who are either always positive or always negative. The always negative ones are just pushing FUD, maybe even hoping to convince you to sell to them at a discount. The always positive ones will miss the signs that a bear market is beginning.

- Look for experts who are positive long term but aren’t afraid to tell you when we are headed for a downturn.

- FOMO + FUD = consistent losing.

For more information on what Bitcoin is, how it works, and how to get started, I can recommend a site and YouTube channel called 99bitcoins. Have you had any experience with Bitcoin? What do you think of it? What hobbies did you pick up while quarantining? Let me know in the comments.